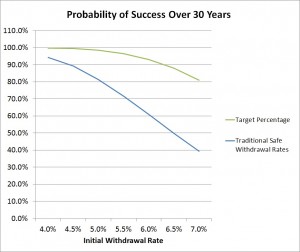

It’s been almost 20 years since Bill Bengen’s article in the Journal of Financial Planning established the 4% Rule as the Gold Standard in retirement planning. Today, financial advisors still regularly recommend a 4% withdrawal rate to their clients. However, there are many misconceptions about the 4% Rule, such as “How much should you withdraw after the first year to sustain the portfolio?” and “How ‘safe’ is this withdrawal strategy?”

There have been many challenges to the 4% Rule. The initial reaction to Bengen’s paper was that 4% is far too low because the high returns of the 1990s surely justified a much higher withdrawal rate. Today, researchers question whether 4% is too high and say retirees need to monitor their portfolios going forward and should be prepared to reduce withdrawals if long-term portfolio survivability is threatened. But what measure of portfolio health should be used? And what action should be taken if this measure indicates danger? With all the uncertainty surrounding withdrawal rates, what’s a retiree (and their financial advisor) to do?

In January 2013, David Zolt authored an article in the Journal of Financial Planning titled “Achieving a Higher Safe Withdrawal Rate With the Target Percentage Adjustment” to address these questions. In this webinar, David reviews the research underpinning the 4% Rule, addresses the current research, and illustrates examples of how his new concept of the Target Percentage is used to monitor portfolio safety and the actions required to extend portfolio longevity. The webinar is about an hour.